who pays sales tax when selling a car privately in california

Use tax applies to the sale of vehicles vessels and aircraft purchased from non-dealers for example private parties or from outside California for use in this state. Do I have to pay sales tax on a car in California.

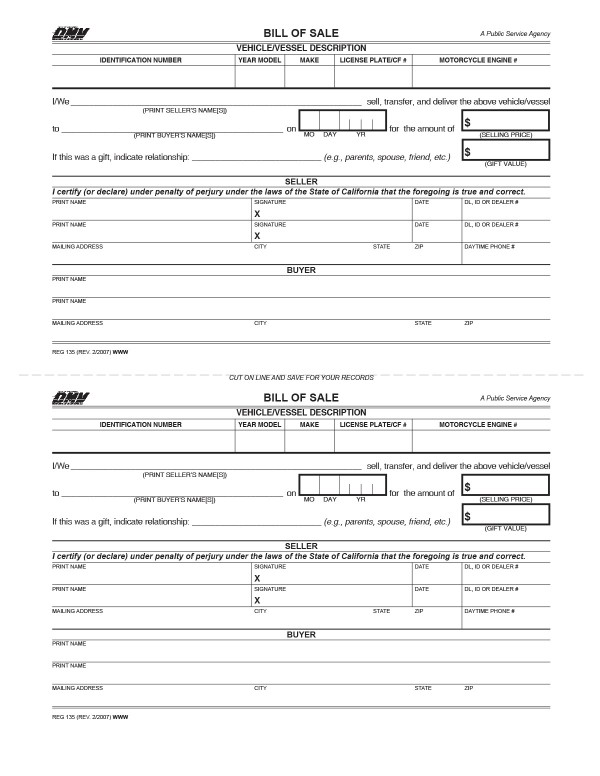

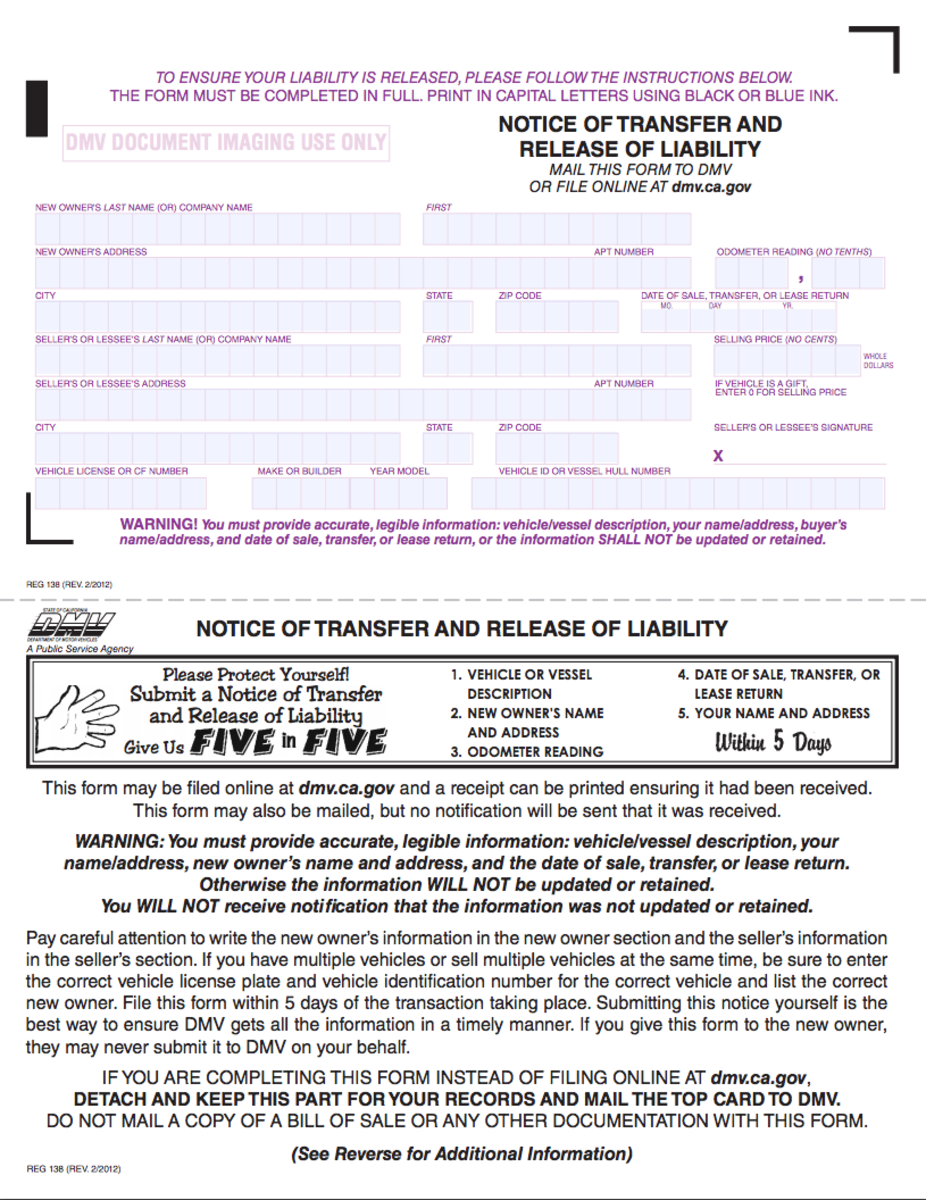

All About Bills Of Sale In California The Facts And Forms You Need

If you are legally able to avoid paying sales tax.

. Personal vehicle sales in New Jersey are not subject to the states 6625 percent sales tax if the seller does not hold a. According to the Sales Tax Handbook because vehicle purchases are prominent in Illinois they may come with substantial taxes. Release of your ownership of the car by signing the designating line on the title certificate.

The buyer is responsible for paying the sales tax. Learn how to sell your used car or truck privately in California. When youre purchasing a new or used car its important to understand the taxes and fees you may face.

The steps and process for selling a vehicle online are different in every state. You can avoid paying sales tax on a used car by meeting the exemption circumstances which include. Sales tax in California varies by location but the statewide vehicle tax is 725.

If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. California statewide sales tax on new used vehicles is 725. New legislation Assembly Bills 82 and 85 Chapters 14 and 8.

The Business Tax and Fee Department and the Field Operations Division are responsible for administering Californias state local and district sales and use tax programs which provide. Lien holders must also sign the title if applicable. You will register the vehicle in a state with no sales tax because.

The CA DMV requires that you provide. Sales tax varies by state but overall it will add several hundred or even a thousand dollars onto the price of buying a car. While the details of private sales may be.

Certain dealers licensed exclusively to sell used vehicles face changes in the way they pay sales taxes beginning January 1 2021. In most cases the IRS and your local tax agencies expect tax payments for gains received on private sales transactions. To take over ownership of a vehicle you will need.

You do not need to pay sales tax when you are selling the vehicle. Who pays sales tax when selling a car privately in NJ. Of the 725 125 goes to the county.

Their signature is required on Line 1 of the. The short answer is yes. Thankfully the solution to this dilemma is pretty simple.

The vehicles title sometimes referred to as a pink slip signed by the person selling the car. NHTSA odometer disclosure requirements were updated in. Who pays sales tax on private car sale California.

For example theres a state sales tax on the.

Free Bill Of Sale Forms 24 Word Pdf Eforms

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

Car Title Transfers How To Gift A Vehicle In California Etags Vehicle Registration Title Services Driven By Technology

Understanding California S Sales Tax

How To Fill Out A Nj Vehicle Title When Buying Or Selling A Car Private Sale Youtube

Understanding California S Sales Tax

How To Close A Private Car Sale Edmunds

Which U S States Charge Property Taxes For Cars Mansion Global

California Used Car Sales Tax Fees 2020 Everquote

Understanding California S Sales Tax

Private Party Vehicle Registration

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Register Vehicles Purchased In Private Sales California Dmv

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

New And Used Car Sales Tax Costs Examined Carsdirect

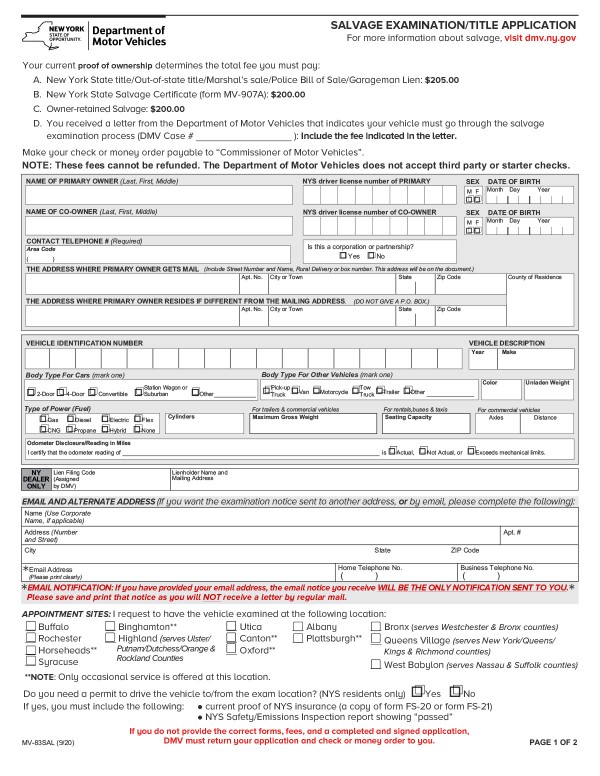

All About New York Bills Of Sale Forms You Need Facts To Know

How To Sell A Car In California 10 Steps With Pictures

How To Buy A Used Car From A Private Seller In California Axleaddict

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog