tax loss harvesting rules

So now that we know what tax harvesting is and how it can help us save on taxes lets discuss two rules to remember so you perform tax harvesting properly. Financial Planning Tax Planning.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

As with any tax-related topic there are rules and limitations.

. Some tax-loss harvesting limitations may include the limit on how many capital losses can be used in a year to offset capital gains for both short- and long-term losses. Normally when you are tax-loss harvesting stocks or mutual funds or bonds or whatever you cannot buy back what you just sold for 30 days. After realizing losses investors may want to reinvest.

This rule disallows your loss if you sell a security and purchase a substantially identical security in 30 days or less. As mentioned above theres a limit to how much you can reduce your ordinary income each year through tax-loss harvesting. Use the power of tax-loss carryforwards.

This illustrates that tax loss harvesting is more impactful for short-term gains but is still useful for long-term gains as well. So the real direct indexing tax loss harvesting strategies seek 1 to 2 over and above the index that they mimic. Because the IRS does not tax growth on investments in tax.

However even if you dont have capital gains to report you can tax loss harvest to lower your tax bill. These losses are so useful that investment advisors tax preparers and financial gurus the world over recommend you book. The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their ordinary income.

Tax-loss harvesting is the practice of selling an investment for a loss. But there are two main rules that you should be aware of when it comes to tax-loss harvestingwash sales rules and cost-basis calculations. There are restrictions on using specific types of losses to offset certain gains.

Then any loss you dont use fully is carried over to the following year so you can use it. Federal government allows investors to use capital losses to offset capital gains in a current tax year or carry the loss forward into future years where losses can be kept in perpetuity. Mortgage Interest Tax Deductions May.

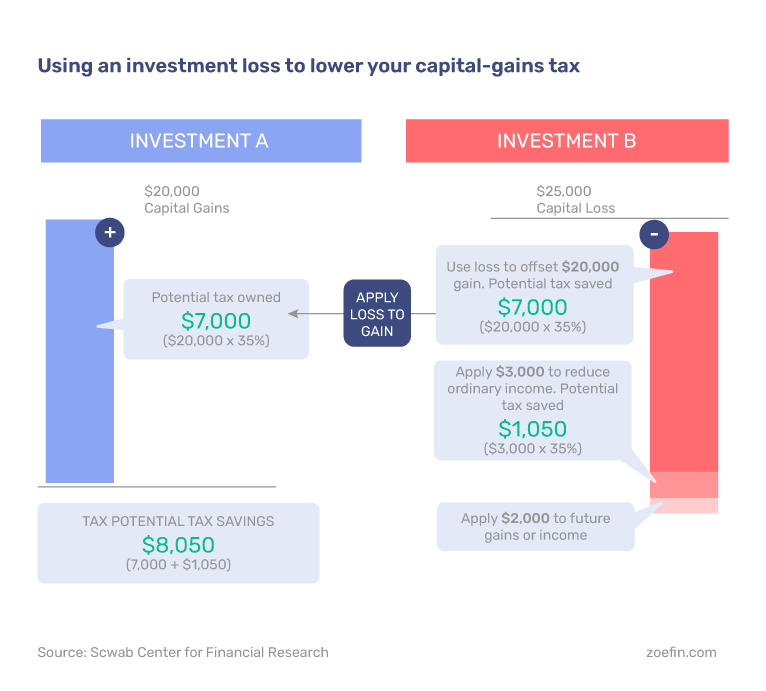

By realizing or harvesting a loss investors can offset taxes on gains and income. What Is Tax-Loss Harvesting. What are the Tax-Loss Harvesting Rules.

2000 x 15 300 2000 - 1500 500 500 x 15 75. You can report up to 3000 per year in losses and offset income. Tax-loss harvesting is the process of writing off the losses on your investments in order to claim a tax deduction against your ordinary income.

To claim a loss for tax purposes. It applies only to investments held in taxable accounts. The idea behind tax-loss harvesting is to offset taxable investment gains.

And specifically with tax loss harvesting strategies theyve proven to outperform through tax alpha. And this leads into what I think is a little bit of a higher level entree into this. If she deployed the same tax loss harvesting strategy she would have reduced her capital gains tax liability from 300 to 75 a reduction of 60.

Rules in Tax Loss Harvesting 1. To claim a loss on your current years taxes youll have to sell investments in taxable accounts before the calendar year ends and then report the action when you file taxes for the year. 250k 150k x 20 percent 20k a number much less than the original 40k calculation 180k 100k x 15 percent 15k less than the 27k from the original calculation In this case tax loss harvesting means the investor only has to pay 35k in taxes instead of the original 67k.

Tax-loss harvesting is a tax strategy where you intentionally sell an investment for a loss in order to offset capital gains taxes elsewhere. Losses also offset gains. Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US.

If you do thats called a wash sale and your loss is disallowed. If the loss exceeds your realized gains for the year that loss can offset up to 3000 of taxable earned income. Learn Tax Consultant Certification - Best Tax Consulting Training - Free Tax Questions.

That sale creates a tax loss that then offsets gains you realized from other investments. This creates more tax-efficient investing. This means that the IRS only allows up to 3000 of capital losses to be used each year to minimize the amount owed on income tax if your tax status is single or youre married and filing jointly.

You can even use tax-loss harvesting to offset taxes owed on regular income. Ad Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022. Tax-loss harvesting isnt useful in retirement accounts such as a 401k or an IRA because you cant deduct the losses generated in a tax-deferred account.

If youd like to read the entire 76-page IRS Publication 550 on investment income it has everything youd need to knowand then some. Now our tax burden is. Tax-loss harvesting lets you manage your tax burden by selling securities like stocks bonds mutual funds and ETFs at a loss to offset the taxes owed on capital gains elsewhere in your portfolio.

Tax Loss Harvesting Top strategies and rules that advisors can consider when using tax loss harvesting to reduce tax. Theres a loophole here for crypto. You are allowed to deduct up to 3000 per year of a short- or long-term capital loss from your ordinary income on your taxes.

Discover The Answers You Need Here. That is not the case with crypto. This all takes place on Schedule D of IRS Form 1040.

3000 per year for individual filers or married couples filing jointly or 1500 per person per year if you are married filing separately.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Top 5 Tax Loss Harvesting Tips Physician On Fire

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Do S And Don Ts Of Tax Loss Harvesting Zoe

Tax Loss Harvesting Everything You Should Know

Year Round Tax Loss Harvesting Benefits Onebite

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Tax Loss Harvesting Definition Example How It Works

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Tax Loss Harvesting Napkin Finance

Turning Losses Into Tax Advantages

Top 5 Tax Loss Harvesting Tips Physician On Fire

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Turning Losses Into Tax Advantages

Tax Loss Harvesting Napkin Finance